The US Cryptocurrency Report: A Comprehensive Analysis

In the ever-evolving landscape of digital assets, cryptocurrencies have emerged as a significant player, drawing the attention of regulators, investors, and the general public alike. The United States, with its robust financial system and technological prowess, has been at the forefront of this revolution. This article delves into the latest report on cryptocurrencies in the US, providing an in-depth analysis from multiple perspectives.

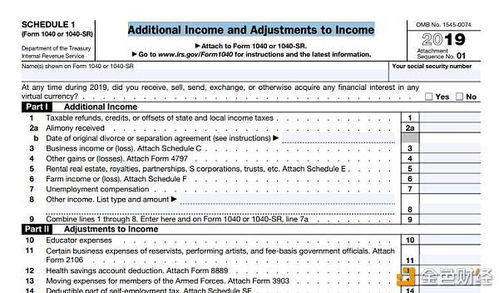

The Regulatory Environment

The regulatory environment surrounding cryptocurrencies in the US is a complex tapestry of laws and regulations. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are among the key agencies tasked with overseeing the cryptocurrency market. The SEC has been particularly active, issuing several warnings and taking actions against fraudulent cryptocurrency schemes. For instance, in late 2021, the SEC filed charges against a prominent cryptocurrency exchange for operating without proper registration, marking a significant victory for regulatory bodies.

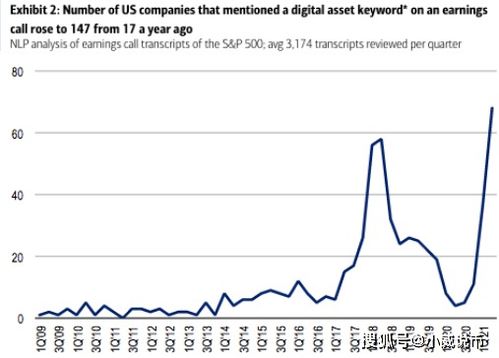

Market Trends and Innovations

One of the most exciting aspects of the US cryptocurrency market is its rapid innovation. Blockchain technology, the backbone of cryptocurrencies, continues to evolve, with new use cases and applications emerging regularly. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs), the potential for digital assets is vast. According to recent reports, DeFi protocols have attracted billions of dollars in investment, showcasing the market's enthusiasm for innovative financial solutions.

Investment and Financing Opportunities

Cryptocurrencies offer unique investment opportunities that are not available in traditional financial markets. High-risk, high-reward investments, such as those found in the Bitcoin and Ethereum ecosystems, have attracted a dedicated following of investors. Additionally, initial coin offerings (ICOs) and security token offerings (STOs) have provided new avenues for companies to raise capital. However, it is crucial for investors to conduct thorough due diligence to mitigate risks.

Challenges and Risks

Despite the potential benefits, the cryptocurrency market is not without its challenges and risks. Volatility is a significant concern, with prices fluctuating wildly in short periods. This volatility can be influenced by various factors, including regulatory developments, market sentiment, and macroeconomic trends. Furthermore, cybersecurity threats pose a constant risk, as hackers continue to target exchanges and other digital asset infrastructure.

The Future of Cryptocurrencies in the US

Looking ahead, the future of cryptocurrencies in the US is poised for continued growth and adaptation. Regulatory frameworks are likely to evolve to better accommodate the burgeoning cryptocurrency market while maintaining investor protection. Technological advancements will drive further innovation, leading to the development of more sophisticated financial products and services.

Conclusion

The US cryptocurrency report presents a multifaceted view of this dynamic industry. From the regulatory landscape to market trends and innovative applications, the US is at the cutting edge of the cryptocurrency revolution. While challenges and risks exist, the potential for growth and development is immense. As the market continues to evolve, staying informed and informed will be key for both investors and regulators alike. The future of cryptocurrencies in the US holds great promise, and it will be fascinating to see how it unfolds in the coming years.